CIBIL Dekho is your trusted partner on the journey to a healthier credit score, offering a range of services designed to address CIBIL score matters effectively.

Your CIBIL score is a vital measure of your creditworthiness when it comes to personal finance. We at CIBIL Dekho provide customized solutions to assist you in navigating the complexity of your credit journey because we are knowledgeable about all aspects of credit management.

A CIBIL score, also known as a credit score, is a numerical representation ranging from 300 to 900, reflecting an individual's credit health.

This three-digit number is derived from an intricate algorithm that considers various financial parameters, such as credit history, repayment patterns, outstanding debts, and the length of credit history.Here you can connect with us we are the best credit counseling service in Hyderabad near you.

In India, credit scores range from 300 to 900, indicating creditworthiness. CIBIL, a prominent credit bureau, generates these scores.

Curious about the calculation process? Calculating credit scores involves analyzing various financial factors. Lenders use this data to assess creditworthiness, empowering individuals to take proactive steps for better credit health.

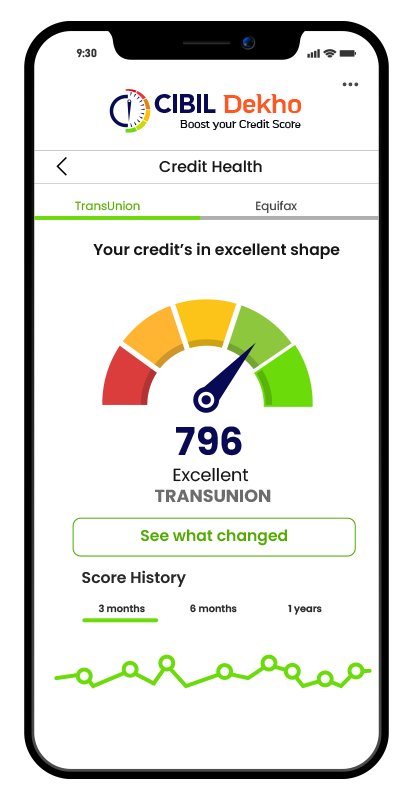

Monitor your credit score and be aware of related terms. Credit rating agencies, like CIBIL, assess and assign scores, compiling comprehensive credit reports. For errors, seek credit report repair services to enhance your credit profile.

Dedicated CIBIL score improvement agencies offer guidance and strategies for improving creditworthiness. Taking steps to fix credit reports includes addressing debts and making timely payments. Proactive credit improvement is crucial for favorable loan terms.

We at CIBIL Dekho know how important having a high credit score is with the help of our services, you will be able to take charge of your financial future. Here's how to do it:

Timely Payments:

Ensure prompt payment of bills and EMIs to demonstrate financial responsibility and contribute to CIBIL score correction.

Debt Management:

Reduce outstanding debts and maintain a healthy debt-to-income ratio, essential steps for effective credit improvement services in India.

Credit Report Review:

Regularly check your credit report for inaccuracies and dispute any errors promptly to ensure accurate credit history repair.

Connect with us we are a leading CIBIL score improvement agency in Hyderabad for personalized solutions.

Avail the expertise of a dedicated repair credit score service to enhance your financial profile.

To stay informed about your financial well-being, it's important to regularly monitor your credit score. It allows you to identify issues early, track improvements, and make informed decisions regarding your credit.

Get Instant Detailed CIBIL Report at just ₹299 (999)

Expertise: Take advantage of the experience and insight of seasoned experts.

Personalized Approach: Every credit situation is unique; our solutions are tailored accordingly.

Transparency: We believe in clear communication and ethical practices.

Unlock a brighter financial future with CIBIL Dekho. Whether you need CIBIL score improvement, detailed credit reports, or expert counseling, we are your one-stop solution.

Soft enquiries, initiated by you, include checking your own credit score or pre-approved credit offers. Importantly, they do not affect your credit score as they are for informational purposes.

Hard inquiries happen when a lender reviews your credit report due to a credit application you've made, like for a credit card or loan. Several in a short period may slightly decrease your credit score.

Rate Shopping Allowance

When shopping for loans (mortgage, auto, etc.), multiple inquiries for the same type of credit within a short period are often treated as a single inquiry to minimize impact.

Monitoring Your Credit Report

Regularly reviewing your credit report helps you stay aware of both soft and hard enquiries. If you spot unauthorized hard enquiries, dispute them promptly with credit reporting agencies.

Understanding this distinction empowers you to make informed decisions about accessing your credit information and take steps to protect your creditworthiness.

At CIBIL Dekho , we specialize in delivering tailored solutions crafted to repair, rebuild, and enhance your CIBIL score

Get Instant Detailed CIBIL Report at just ₹299 (999)